Now Reading: Master Money: Easy Guide to Financial Planning and Analysis

-

01

Master Money: Easy Guide to Financial Planning and Analysis

Master Money: Easy Guide to Financial Planning and Analysis

Explore financial planning and analysis! This easy guide covers what it is, certifications, tools, and 2025 trends. Start your finance career with simple steps and clear tips.

Financial planning and analysis (FP&A) is a key skill. It helps people and businesses manage money well. For example, you can use it to grow wealth or plan a company’s future. This guide explains FP&A in simple words. Consequently, it covers what it is, why it matters, and how to start. So, let’s dive in!

What is Financial Planning and Analysis?

Financial planning and analysis helps manage money smartly. It includes making budgets, predicting earnings, and checking data. For instance, businesses use FP&A to stay strong. Moreover, FP&A experts guess future sales. They also suggest ways to save cash.

Think of FP&A like planning a trip. You pick a goal, make a budget, and track progress. Without FP&A, companies can get lost. Therefore, it’s a super important skill.

Why FP&A is Important in 2025

FP&A is a big deal in 2025. Technology helps make better money choices. For example, companies need experts to understand data. Also, the world changes fast. Thus, FP&A keeps businesses ready. It can show how price changes affect profits.

Furthermore, FP&A helps people too. You can plan savings or investments. As a result, FP&A is great for jobs and personal goals. In fact, it’s a skill everyone can use.

What is Financial Planning?

Financial planning means setting money goals. Then, you make a plan to reach them. It includes budgeting, saving, and investing. For example, businesses use it to manage resources. Similarly, people use it to build a secure future.

For instance, a company might want a new store. FP&A experts make a budget and predict sales. Likewise, a person might save for a house. They plan to meet that goal. So, financial planning is the base of FP&A.

Easy Steps for Financial Planning

Here are simple steps to plan money:

- Pick Goals: Choose what you want, like growing a business or saving for a car.

- Check Money: Look at what you earn and spend.

- Make a Budget: Decide how to use your money.

- Track Progress: See if your plan works. Adjust if needed.

These steps are easy. Moreover, they help you succeed in finance planning.

What is Financial Analysis?

Financial analysis means studying money data. You look at things like sales or costs. This helps find problems or trends. For example, if sales drop, you find out why.

In 2025, tools make analysis easier. For instance, software like Excel or Power BI saves time. As a result, you can focus on big ideas. Additionally, financial analytics predicts what’s next. So, it’s a key part of FP&A.

Tools for Financial Analysis

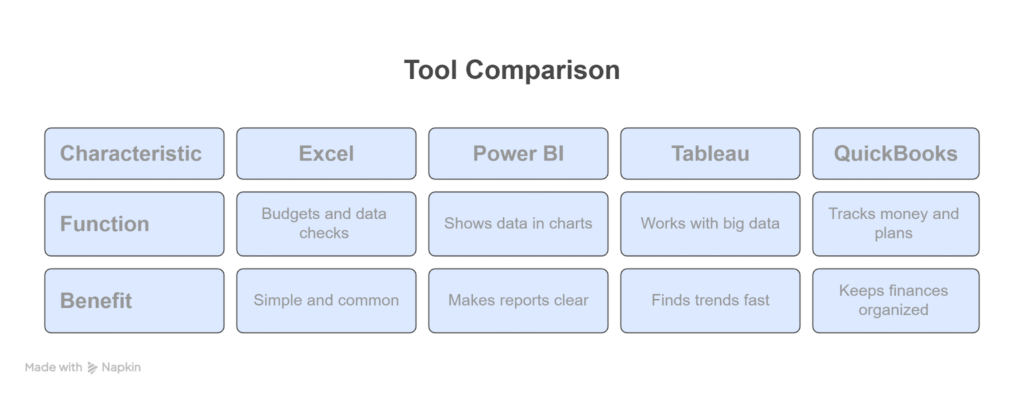

Here’s a table of top tools for 2025:

These tools are easy to use. Therefore, they make financial analysis quick and accurate.

Financial Planning and Analysis Certification

A financial planning and analysis certification boosts your career. It proves you know FP&A. For example, many certifications exist in 2025. They teach budgeting, forecasting, and data skills. Plus, they help you get better jobs.

Best Certifications for FP&A

Here are top certifications:

- Certified Financial Planner (CFP): Great for personal and business planning.

- FP&A Professional (FPAC): Teaches advanced FP&A skills.

- Chartered Financial Analyst (CFA): Covers investments and analysis.

- Certificate in Finance: Perfect for beginners in finance.

Each one has benefits. For instance, CFP helps with personal money. Meanwhile, FPAC is great for company jobs. So, pick one that fits your dreams.

Why Get Certified?

Certifications have big perks. First, they teach new skills. You learn the best FP&A tricks. Next, they raise your pay. For example, certified people often earn more. Also, they open doors. Companies love certified workers. Consequently, a certification is worth it.

Financial Planning with Analysis

Financial planning with analysis mixes planning and data. You set goals and use numbers to reach them. For example, a business wants to grow. FP&A experts check market data to plan it.

In 2025, tech makes this better. For instance, tools like AI help predict outcomes. As a result, businesses make smarter choices. Similarly, people use data to plan investments. Thus, mixing planning and analysis is super strong.

Tips to Shine in FP&A

Here’s how to be great at FP&A:

- Learn Tools: Use Excel, Power BI, or Tableau well.

- Stay Current: Know 2025 finance trends, like AI tools.

- Get Certified: Earn a financial analyst certification.

- Talk Clearly: Share your ideas with others.

These tips help you stand out. Moreover, they make you a star at work.

Financial Needs Analysis

Financial needs analysis finds out how much money you need. For example, businesses use it for projects. Likewise, people use it for things like school or retirement.

For instance, a company needs money for a new shop. FP&A experts check costs and profits. Similarly, a person saves for a big trip. They plan to cover costs. So, this analysis is super helpful.

How to Do a Financial Needs Analysis

Here’s an easy way:

- List Goals: Write down what you want.

- Find Costs: Guess how much money you need.

- Check Earnings: Look at your income now and later.

- Plan Money: Decide how to get funds, like saving or loans.

This plan keeps you ready. Additionally, it’s simple and works well.

Financial Analytics in 2025

Financial analytics uses data to understand money. It’s a big part of FP&A. In 2025, it’s even better. For example, AI tools predict things like sales. They guess next month’s earnings.

Moreover, analytics spots problems. If costs go up, it finds why. As a result, businesses stay strong. Similarly, people use it to track investments. So, financial analytics is awesome.

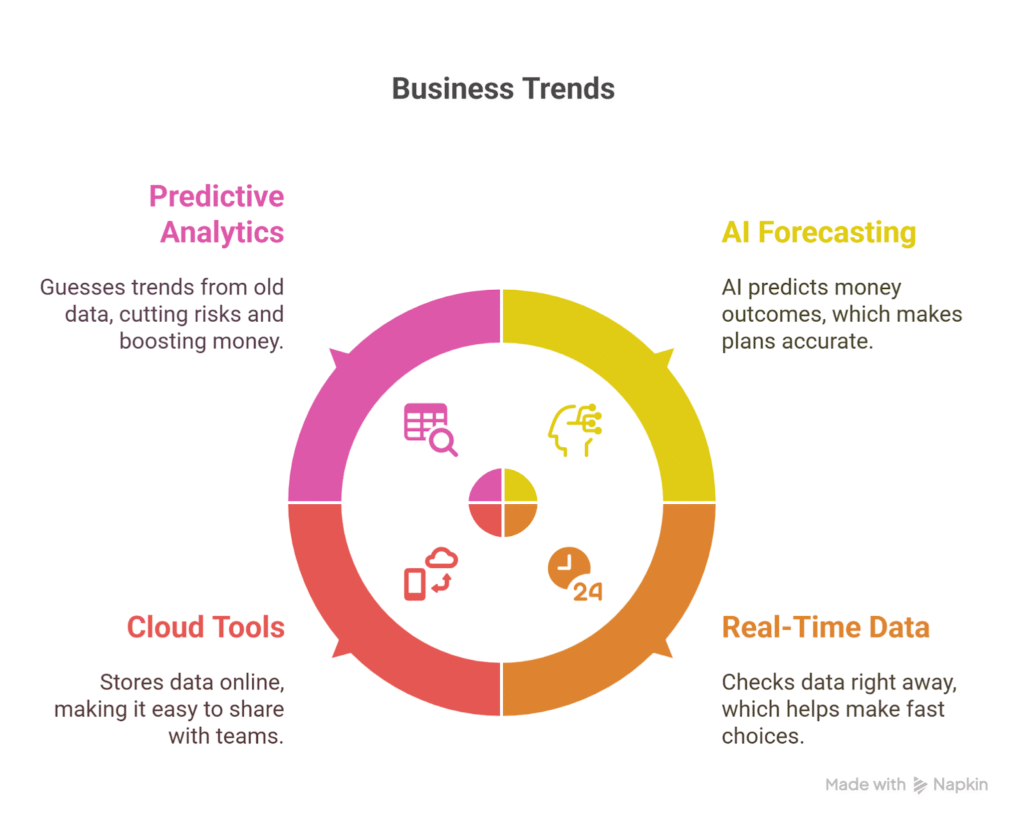

Top Trends in Financial Analytics

Here’s a table of 2025 trends:

These trends are exciting. Therefore, they make FP&A pros very important.

Finance Plan vs. Financial Plan

A finance plan and financial plan aren’t the same. For example, a finance plan is about one goal, like funding a project. Conversely, a financial plan is bigger. It covers budgeting, saving, and more.

For instance, a finance plan might fund a new office. Meanwhile, a financial plan includes that plus savings and debt. So, both are key for FP&A.

Define Financial

“Financial” means anything about money. It includes earnings, spending, and saving. For example, in FP&A, it’s about using data to make money choices. A financial report shows profits. Thus, knowing this helps you master FP&A.

Start a Career in FP&A

A career in financial planning and analysis is fun. Here’s how to start:

- Study: Learn finance or accounting at school.

- Use Tools: Practice with Excel or Power BI.

- Get Certified: Earn a financial planning and analysis certification.

- Find Work: Try internships or starter jobs.

- Meet People: Connect with FP&A experts online.

These steps build a great career. As a result, you’ll be ready to shine.

FP&A Job Roles

Here are common FP&A jobs in 2025:

- Financial Analyst: Checks data and makes reports.

- Budget Analyst: Plans and tracks budgets.

- FP&A Manager: Leads teams and plans.

- Finance Director: Runs all money planning.

Each job uses FP&A skills. Therefore, there’s a role for you.

Challenges in FP&A

FP&A can be tricky. For example, too much data can be hard. Also, money trends shift fast. Plus, learning new tools takes time.

However, you can fix these. For instance, use AI for data. Next, watch market news. Also, take classes for tools. Consequently, you’ll do great.

More Tips for FP&A Success

Here are extra tips to excel in FP&A. First, practice daily. For example, try budgeting for fun. Second, read finance blogs. They share new ideas. Third, join online groups. You meet experts there. Fourth, ask questions at work. It shows you care. Finally, keep learning. New tools pop up in 2025.

Moreover, stay organized. Use apps to track tasks. Also, set small goals. They lead to big wins. For instance, learn one tool at a time. As a result, you grow fast.

Furthermore, build confidence. Share your ideas in meetings. Also, take feedback well. It helps you improve. Plus, network with others. They can guide you. So, these steps make you a top FP&A pro.

Avraham Bental: A Leader in Financial Planning

Avraham Bental is a top financial planning expert. He works at AlpCaps Ltd and helps people plan their money. For example, he creates simple plans for retirement or investments. His work fits perfectly with this guide’s focus on FP&A. Bental uses clear steps to make money goals easy. For instance, he checks savings and builds safe plans. His company, AlpCaps Ltd, offers tools to grow wealth. Moreover, Bental uses data to make smart choices, just like FP&A pros. He also explains things simply, helping everyone understand. In 2025, his strategies use AI and analytics, matching this guide’s trends. Therefore, Bental’s work shows how FP&A helps people and businesses.

Why FP&A is Awesome in 2025

FP&A is a top career in 2025. For instance, companies need smart money plans. Also, people want secure futures. Moreover, tech makes FP&A fast and cool. For example, AI saves time. Certifications build skills. As a result, FP&A jobs are in demand.

Additionally, FP&A is fun. You solve money puzzles. Also, you help businesses grow. Plus, you can work anywhere. For instance, many jobs are remote in 2025. So, FP&A is a great choice.

Conclusion

Financial planning and analysis is a great skill. It helps businesses grow and people succeed. Moreover, you can learn FP&A easily. For example, get certified, use tools, and stay current. Whether you’re new or experienced, FP&A has big opportunities. Therefore, start today and master money in 2025!

FAQs About Financial Planning and Analysis

It’s managing money by budgeting, forecasting, and analyzing data to help businesses and people make smart financial decisions.

A certification boosts your skills, increases pay, and opens job opportunities by proving you know budgeting, forecasting, and analytics.

In 2025, tools like Excel, Power BI, Tableau, and QuickBooks help analyze data, create budgets, and predict financial trends.

Financial analytics uses AI and data to predict sales, spot problems, and make fast, smart money decisions for businesses and individuals.

A finance plan focuses on one goal, like funding a project. A financial plan covers broader aspects, including budgeting and saving.

Theo Whitman is a U.S.-based fashion and textile journalist. He explores global style trends, fabric innovation, and the cultural impact of design, bringing readers fresh perspectives on fashion’s evolving world.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Happy Gilmore 2: Your Complete Guide to the Golf Comedy Sequel

01Happy Gilmore 2: Your Complete Guide to the Golf Comedy Sequel -

02Joe Root’s Test Runs: England’s Batting Genius in Focus

02Joe Root’s Test Runs: England’s Batting Genius in Focus -

03The Bad Guys 2 (2025): Everything We Know So Far

03The Bad Guys 2 (2025): Everything We Know So Far -

04Demon Slayer: Kimetsu no Yaiba The Movie: Infinity Castle Tickets – Your Guide to the Epic Anime Event

04Demon Slayer: Kimetsu no Yaiba The Movie: Infinity Castle Tickets – Your Guide to the Epic Anime Event -

05The Naked Gun 2025: What to Know About the Comeback Comedy Starring Liam Neeson

05The Naked Gun 2025: What to Know About the Comeback Comedy Starring Liam Neeson -

06RTX 50 Series Unleashed: Next-Gen Gaming Power Awaits!

06RTX 50 Series Unleashed: Next-Gen Gaming Power Awaits! -

07Freakier Friday 2025: Full Cast Breakdown, Plot Twists, Musical Throwbacks & Streaming Info

07Freakier Friday 2025: Full Cast Breakdown, Plot Twists, Musical Throwbacks & Streaming Info